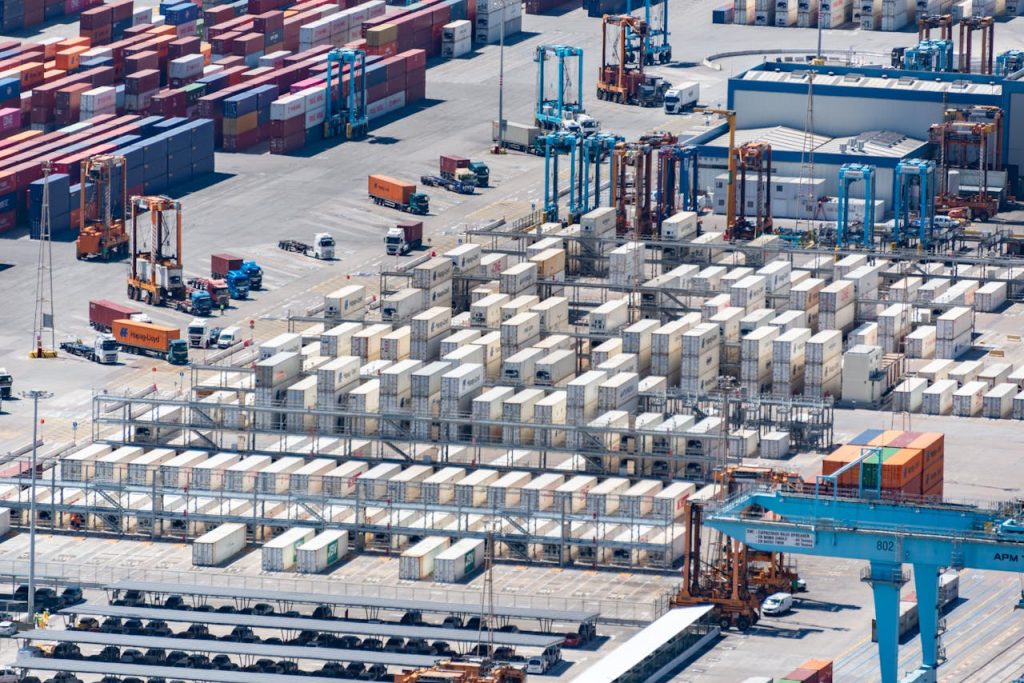

Modern trade relies heavily on the seamless movement of goods, and container terminals sit at the heart of this process. These hubs handle millions of boxes annually, linking ships, trucks, and trains in a carefully orchestrated dance. Yet, keeping everything running smoothly is no small feat.

From ageing infrastructure to environmental pressures, terminals face a web of interconnected complexities. Ports must juggle limited space with rising cargo volumes, while labour shortages and competition for shipping routes add further strain. Even minor delays can ripple across supply chains, impacting businesses globally.

Automation offers promising solutions, but integrating new tech without disrupting existing operations remains tricky. Balancing cost-efficiency with sustainability goals complicates matters further. We’ll unpack these hurdles, and the strategies tackling them, in the sections ahead.

Key Takeaways

- Container terminals face pressures from infrastructure limits and rising cargo volumes

- Labour shortages and environmental regulations compound operational difficulties

- Automation improves efficiency but requires careful implementation

- Space constraints at ports create logistical bottlenecks

- Global competition drives need for continuous process optimisation

Introduction to Container Terminal Management

Efficient logistics networks depend heavily on well-managed port facilities. These hubs orchestrate the movement of over 80% of globally traded goods, according to recent maritime reports. Even smaller terminals handle thousands of containers weekly, proving their critical role in keeping supply chains fluid.

Setting the Stage for Global Trade

Modern terminal operations blend physical infrastructure with digital systems. Many ports now use real-time tracking sensors and automated stacking cranes. This shift allows operators to process 30% more cargo daily compared to manual methods from a decade ago.

Data analysis drives smarter decisions in container handling. For example:

- GPS tags monitor shipment locations

- AI predicts equipment maintenance needs

- Cloud platforms share updates across transport modes

Such innovations help ports manage tighter schedules and larger vessels. A 2023 study showed terminals using predictive analytics reduced idle times by 17%. This progress supports the shipping industry’s push for faster turnarounds without sacrificing safety.

| Aspect | Traditional Approach | Modern Approach |

|---|---|---|

| Equipment | Manual cranes & spreaders | Remote-controlled straddle carriers |

| Data Usage | Paper-based records | IoT-enabled performance dashboards |

| Decision-Making | Weekly planning cycles | Live adjustments via machine learning |

| Environmental Impact | High diesel consumption | Hybrid-electric machinery |

Balancing these upgrades with existing processes remains key. Ports that successfully integrate new technology often see 20-35% improvements in cargo throughput. We’ll explore how these changes address specific operational hurdles in later sections.

What Are the Challenges of Container Terminal Management?

Behind every smoothly running port lies a web of logistical puzzles. Terminal operators juggle multiple pressures daily, from unpredictable cargo volumes to razor-thin profit margins. Let’s peel back the curtain on the hurdles shaping this critical industry.

Key Obstacles and Industry Impacts

Container handling bottlenecks emerge as a top pain point. A 2023 analysis revealed mid-sized terminals waste 22% of crane movements due to poor yard layouts. These inefficiencies ripple through operations, increasing costs by £14-£19 per container handled.

Consider these operational pressure points:

- Labour costs consuming 40-60% of terminal budgets

- Berth congestion delaying 1 in 5 vessels

- Software integration failures causing 12% productivity drops

| Metric | Small Terminals | Large Terminals |

|---|---|---|

| Cost per TEU | £85-£110 | £55-£75 |

| Crane utilisation | 68% | 82% |

| Dwell time reduction | 7% (2020-2023) | 19% (2020-2023) |

Process complexities hit smaller ports hardest. Many lack funds for automation, forcing manual container tracking that doubles error rates. This performance gap pushes shipping lines towards mega-terminals, creating a ‘survival of the biggest’ dynamic across global trade routes.

These challenges don’t stay confined to individual ports. When multiple terminals struggle, supply chains face compound delays, recent data shows 31% of global shipping holdups originate in port operations. The stakes for solving these issues couldn’t be higher.

Infrastructure and Space Limitations

Port operators often find themselves playing a high-stakes game of Tetris with shipping containers. Older terminals face particular strain, with 62% reporting yard utilisation rates above 90% in 2023 surveys. This spatial crunch forces tough choices between stacking density and equipment access.

Limited Physical Capacity and Site Constraints

Many facilities simply weren’t designed for today’s mega-ships and container volumes. A typical 10-acre yard might handle 15,000 TEUs monthly, but demand often exceeds 20,000. Retrofitting existing layouts becomes costly, with crane rail extensions alone averaging £2.3m per project.

Common bottlenecks include:

- Storage zones blocking straddle carrier paths

- Insufficient berth depth for larger vessels

- Outdated IT systems mismanaging container flows

Innovative Digital Twin Solutions

Virtual modelling tools now help ports squeeze more value from cramped spaces. Rotterdam’s Maasvlakte II terminal used digital twins to boost yard efficiency by 27% without physical expansion. These 3D simulations test layout changes and equipment configurations in real-time.

| Strategy | Traditional Approach | Digital Twin Impact |

|---|---|---|

| Equipment Placement | Manual trial-and-error | 15% faster deployment |

| Container Stacking | Fixed height limits | 22% density increase |

| Gate Scheduling | Peak-time congestion | 31% queue reduction |

These tools also predict how new cranes or storage blocks affect operations. Hamburg’s Altenwerder terminal cut rehandling costs by £1.8m annually through simulated workflow adjustments. The technology pays for itself within 18 months at most mid-sized ports.

Financial Constraints and Investment Challenges

Upgrading port facilities often feels like solving an equation with too many variables. Smaller terminals face particular pressure, with technology investments consuming 35-50% of annual budgets in recent surveys. Balancing immediate expenses against long-term gains requires careful planning.

Modernisation projects carry hefty price tags. A single automated stacking crane costs £1.2m-£2.7m, equivalent to 18 months’ revenue for many regional ports. These figures don’t include software integration or staff training, which add 40% to initial outlays.

Costs of Upgrading Facilities and Adopting Technology

Port operators prioritise scalable solutions that grow with demand. Cloud-based terminal operating systems offer flexibility, reducing upfront costs by 60% compared to legacy platforms. However, monthly subscription fees still strain tight budgets.

- Sensor networks: £85,000 setup + £12,000/year maintenance

- AI-powered yard planners: £220,000 licensing fees

- Equipment automation retrofits: £45,000 per crane

Strategic partnerships help spread financial risks. Some terminals use performance-based funding models, tying technology payments to measurable efficiency gains. This approach has helped 28% of mid-sized ports achieve ROI within 3 years.

| Expense Type | Traditional Systems | Modern Systems |

|---|---|---|

| Software Updates | £18,000/5 years | £4,200/year |

| Maintenance | Reactive repairs | Predictive monitoring |

| Energy Use | High diesel reliance | Hybrid-electric savings |

Forward-thinking terminals view upgrades as survival investments rather than optional extras. Those delaying modernisation face 7-12% annual cost increases versus 4-9% savings for early adopters. The maths increasingly favours bold action.

Competition Among Container Terminals

The global shipping industry resembles a high-speed race where ports jostle for pole position. Mega-terminals now handle 58% of worldwide container traffic, leaving smaller operators scrambling to retain clients. This concentration creates intense pressure to deliver faster turnarounds and smarter services.

Pressure from Larger Operators in a Competitive Market

Dominant players leverage their scale to offer aggressive pricing and 24/7 operations. A 2023 study revealed major hubs process containers 40% quicker than regional rivals, thanks to automated systems and deeper berths. This efficiency gap forces smaller ports to rethink their strategies.

Consider these market realities:

- Top 10 terminals control 35% of global trade volumes

- Mega-ports invest £200m+ annually in technology upgrades

- Shipping alliances prioritise partners with advanced tracking systems

| Competitive Edge | Large Terminals | Smaller Operators |

|---|---|---|

| Technology Budget | £18-25m/year | £2-5m/year |

| Vessel Turnaround | 12-18 hours | 22-30 hours |

| Customisation | Standardised processes | Niche service offerings |

Regional ports counter scale advantages through specialisation. Some focus on refrigerated cargo handling, while others target key challenges in container port operations like last-mile connectivity. Smart sensors and AI-driven yard planners help level the playing field, one Mediterranean terminal boosted productivity by 19% using these tools.

Success increasingly hinges on balancing cost-efficiency with unique value propositions. Operators blending tailored services with lean operations report 14-21% higher customer retention rates. The race isn’t just about size – it’s about running smarter.

Environmental Compliance and Sustainable Practices

Ports worldwide now face a dual mandate: meet strict environmental rules while maintaining profitability. Green regulations have tightened significantly, with 73% of terminals reporting increased compliance costs since 2020. Balancing ecological responsibility with operational demands requires smart solutions and forward planning.

Navigating Regulatory Demands and Standards

New sulphur caps and carbon taxes reshape port operations. The IMO 2020 rule alone forced 89% of terminals to upgrade fuel systems. Many facilities now use IoT sensors to track emissions in real-time, cutting reporting errors by 41%.

Common compliance strategies include:

- Installing shore power stations for docked vessels

- Adopting low-sulphur fuels for yard equipment

- Using AI-driven data tools to predict regulatory changes

Implementing Eco-friendly Innovations

Leading ports prove sustainability boosts efficiency. Rotterdam’s Maasvlakte terminal slashed energy use 34% through solar-powered cranes and hydrogen straddle carriers. Their smart grid system redirects surplus power to nearby communities.

| Initiative | Traditional Approach | Sustainable Solution |

|---|---|---|

| Equipment Power | Diesel generators | Hybrid-electric systems |

| Lighting | High-wattage floodlights | Motion-activated LEDs |

| Waste Management | Landfill disposal | AI sorting + recycling |

These practices often pay for themselves. Hamburg’s container terminal reduced annual costs by £2.1m after switching to electric terminal trucks. As regulations evolve, ports embracing green tech gain both environmental and competitive advantages.

Enhancing Operational Efficiency and Cargo Handling

Port operators constantly seek smarter ways to keep goods moving swiftly. By refining workflows and embracing innovation, terminals can tackle today’s throughput demands while preparing for tomorrow’s challenges. Let’s explore practical approaches making waves in modern port management.

Optimising Cargo Flow and Process Improvements

Streamlining container movements starts with smart layout designs. Digital twin simulations help ports test stacking patterns and equipment placements virtually before implementation. TTI Algeciras boosted productivity by 18% using this method, reducing vessel turnaround by 22%.

Key strategies include:

- Automated stacking cranes with 95% positioning accuracy

- Real-time container tracking via RFID tags

- Dynamic berth allocation based on weather forecasts

Integrating Advanced Technologies for Efficiency

Modern terminals blend physical upgrades with digital insights. AI-powered yard planners at Busan Port cut rehandling costs by £1.4m annually through predictive container positioning. IoT sensors now monitor 83% of equipment health indicators, enabling proactive maintenance.

| Area | Traditional Method | Tech-Driven Approach |

|---|---|---|

| Loading Speed | 25 containers/hour | 38 containers/hour |

| Error Rate | 12% manual entries | 2% automated scans |

| Fuel Use | 45 litres/crane shift | 28 litres/crane shift |

These advancements support improving container terminal operations through better decision-making. Blockchain systems now streamline documentation, slashing processing times from days to hours. The result? Happier shipping lines and more resilient supply chains.

Labour Management and Automation: Bridging the Workforce Gap

Port operators face a tricky balancing act as workforce dynamics shift. While automation reshapes container handling, skilled workers remain vital to smooth operations. Getting this mix right determines whether terminals thrive or struggle.

Addressing Skill Shortages and Workforce Challenges

Recruiting crane operators and logistics planners has become 37% harder since 2020, according to maritime industry reports. Many experienced workers retired during the pandemic, leaving knowledge gaps that take years to fill.

Forward-thinking ports tackle this through:

- VR simulators training new hires in 8 weeks vs 6 months

- Cross-training programmes for equipment versatility

- E-learning platforms updating staff on latest systems

These approaches help existing teams adapt to automated processes. A UK terminal reduced onboarding time by 63% using gamified training modules.

Leveraging Automation to Improve Productivity

Automated straddle carriers and AI yard planners now handle 45% of container movements at advanced terminals. This tech doesn’t replace workers – it lets them focus on complex tasks machines can’t manage.

| Task | Manual Approach | Automated Solution |

|---|---|---|

| Container Sorting | 32/hour | 89/hour |

| Error Rate | 9% | 1.2% |

| Overtime Costs | £18k/month | £6k/month |

Hybrid models prove most effective. Rotterdam’s APMT terminal reports 19% higher productivity since pairing automated cranes with upgraded control systems. Workers now monitor multiple machines through central dashboards rather than operating single units.

Success lies in blending human expertise with smart technology. Ports mastering this balance achieve 22% faster cargo turnarounds while keeping staff engagement high. The future workforce will look different, but remains essential.

Conclusion

Navigating modern port operations requires balancing automation with human expertise. As terminals grapple with space limits and environmental rules, data-driven systems emerge as game-changers. Real-time analytics help optimise yard layouts, while predictive maintenance slashes equipment downtime.

Sustainable practices now drive competitive advantage. Hybrid-electric cranes and AI-powered energy grids cut costs by 19-34% in forward-thinking ports. These upgrades prove eco-efficiency isn’t just ethical, it’s economically smart.

Workforce strategies remain crucial. Upskilling programmes paired with automated solutions let teams focus on complex logistics tasks. Rotterdam’s success with remote-controlled straddle carriers shows hybrid models boost both productivity and job satisfaction.

We believe terminals embracing smart solutions will lead tomorrow’s supply chains. From blockchain documentation to dynamic berth allocation, innovation bridges today’s challenges with future opportunities. Let’s keep global trade networks flowing smoother, faster and greener.