Staying ahead of financial crime isn’t just a legal box-ticking exercise – it’s a critical shield for banks, fintechs, and other organisations handling money. With global money laundering flows estimated at 2-5% of GDP (up to $2 trillion annually), robust systems to detect illicit activity have never been more vital. Let’s explore why these measures matter and how they shape modern finance.

AML compliance isn’t solely about following rules like the Bank Secrecy Act. It’s about creating barriers against criminals exploiting legitimate systems. When institutions fail here, the fallout extends beyond fines – trust erodes, share prices tumble, and recovery takes years.

Effective frameworks do more than satisfy regulators. They protect customers from fraud, disrupt terrorism funding, and maintain economic stability. Recent analyses show that 95% of compliance failures involve inadequate risk assessments – a stark reminder of what’s at stake.

Key Takeaways

- Global money laundering equals $800bn-$2tn yearly – rivaling national economies

- AML rules form legal obligations under acts like the Bank Secrecy Act

- Non-compliance risks multimillion penalties and lasting reputational harm

- Strong systems safeguard both clients and institutional credibility

- AML and counter-terrorism financing measures are fundamentally linked

Overview of Anti-Money Laundering Compliance

Let’s start by unpacking what keeps illicit funds out of legitimate systems. Anti-money laundering refers to processes that prevent criminals from disguising illegally obtained cash as clean money. At its core, it’s about disrupting three stages: placement, layering, and integration of dirty funds.

Definition and Key Concepts

Financial crimes aren’t just Hollywood-style heists. They include tax evasion, fraud, and cyber-enabled schemes that exploit digital payment systems. Modern AML regulations require institutions to:

- Verify customer identities through Know Your Customer checks

- Monitor transactions for unusual patterns

- Report suspicious activity to authorities

Historical Context and Evolving Regulations

The 1970 Bank Secrecy Act first required US banks to report large cash transactions. But everything changed after 9/11, when AML regulations expanded to combat terrorist financing globally.

Today, 40+ countries follow FATF guidelines. These standards adapt constantly – recent updates target cryptocurrency risks and AI-driven fraud. What began as basic record-keeping now involves real-time data analysis across borders.

The Importance of Anti-Money Laundering Compliance in Financial Institutions

Robust financial safeguards act as society’s first line of defence against shadow economies. When institutions prioritise detecting suspicious activity, they don’t just comply with laws – they disrupt criminal networks funding everything from drug cartels to terrorist financing operations.

Protecting the Financial System

Imagine a bank unknowingly processing dirty money for arms dealers. Effective AML controls prevent this by flagging unusual financial transactions, like sudden large deposits or cross-border transfers. These red alerts enable timely Suspicious Activity Reports (SARs) through systems like the BSA E-Filing portal.

Maintaining bank secrecy standards isn’t about hiding information – it’s about responsibly shielding data from misuse. Institutions balancing privacy with transparency under the Secrecy Act help block funding pipelines for cybercrime and human trafficking.

Safeguarding Reputation and Shareholder Value

News of compliance failures spreads faster than ransomware. A single terrorist financing case can erase years of customer trust. Conversely, strong AML frameworks attract investors – 78% of shareholders now prioritise ethical banking practices.

We’ve seen banks recover faster from data breaches than compliance scandals. Proactive monitoring of financial transactions demonstrates operational integrity, directly impacting stock prices and client retention rates. It’s not just about avoiding fines – it’s about building institutions people believe in.

Regulatory Framework and Global Standards

What holds the global fight against dirty money together? A patchwork of national laws and cross-border agreements forms the backbone of modern AML efforts. While rules vary by region, their shared goal remains: making financial systems hostile to criminal exploitation.

Understanding the Bank Secrecy Act and AML Regulations

America’s Bank Secrecy Act (BSA) started it all in 1970. This landmark law requires banks to:

- Report cash transactions over $10,000

- Keep detailed records for five years

- Share suspicious activity through SARs

Recent updates now cover cryptocurrency exchanges and prepaid cards. Over 500,000 SARs were filed in 2022 alone – proof these regulations drive real action against money laundering schemes.

The Role of International Bodies and FATF Guidelines

Global problems need global solutions. The Financial Action Task Force (FATF) sets standards followed by 200+ countries. Their 40 Recommendations outline best practices for:

- Freezing terrorist assets

- Tracing cross-border payments

- Auditing high-risk customers

When institutions align with FATF guidelines, they’re not just ticking boxes. They’re helping dismantle networks that move illegal money through shell companies and offshore accounts.

Risk Management and Customer Due Diligence

How do financial gatekeepers separate legitimate funds from criminal proceeds? The answer lies in layered checks that evolve with each customer interaction. Robust due diligence acts like a financial MRI scan – revealing hidden risks before they metastasise.

Know Your Customer (KYC) Procedures

KYC isn’t just checking IDs. It’s about understanding who’s behind each transaction. We start by verifying identities through government-issued documents and biometric checks. But the real magic happens in ongoing activity monitoring – spotting sudden changes in account behaviour that might signal money laundering.

Implementing Customer Due Diligence (CDD)

Effective CDD adapts to risk levels. Low-risk accounts might need basic checks, while high-net-worth clients require deeper scrutiny. Three pillars guide our approach:

- Transaction patterns: Establishing typical payment sizes and frequencies

- Funds sourcing: Tracing deposit origins through banking records

- Relationship mapping: Identifying connected accounts or beneficiaries

Regular monitoring catches 63% of suspicious activities within six months. By prioritising high-risk transactions, institutions allocate resources smartly – like cybersecurity teams focusing on critical vulnerabilities.

Leveraging Technology in AML Compliance

Modern finance meets its match in digital crime-fighting tools. Institutions now deploy advanced systems that outpace traditional methods, transforming how we identify and stop illicit activities. Let’s unpack the tech reshaping this critical battlefield.

Automated Screening and Verification Tools

Gone are the days of manual transaction reviews. Today’s algorithms scan millions of payments in seconds, flagging patterns linked to financial crime. One bank reduced false positives by 40% using AI that learns from historical customer activities.

Enhancing Biometric and Data Verification Methods

Facial recognition and liveness checks now verify identities faster than human agents. These systems cross-reference global databases, spotting forged documents in real time. A recent trial saw 98% accuracy in detecting synthetic IDs – a game-changer for high-risk customers.

Integrating Monitoring Systems for Suspicious Activity

Unified dashboards track account behaviour across currencies and borders. When a transaction deviates from established patterns, alerts trigger automatically. This proactive approach helped freeze £2.3bn in illegal money flows last year alone.

By blending these technologies, institutions achieve more than compliance – they build smarter defences. The result? Faster detection, lower costs, and systems that adapt as criminals evolve. Isn’t it time your tools did the heavy lifting?

Challenges and Consequences of Non-Compliance

Ignoring AML rules isn’t just risky – it’s a fast track to operational chaos. When systems fail, institutions face more than paperwork headaches. Real-world impacts range from existential business threats to shattered client relationships.

Financial Penalties and Legal Repercussions

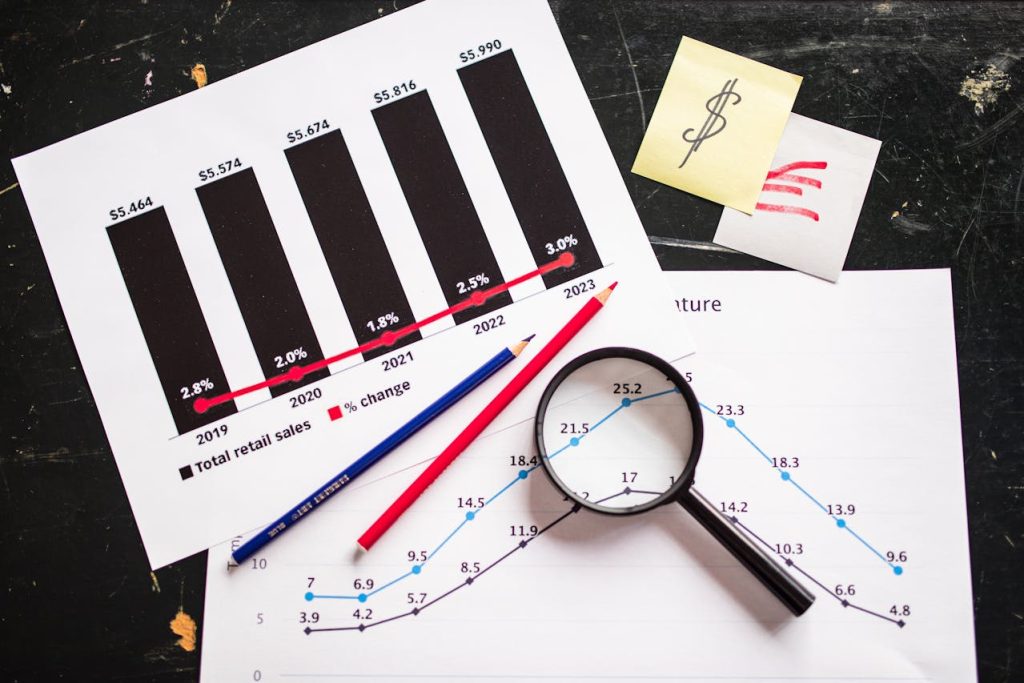

Regulators aren’t playing nice. Last year saw $5.4 billion in global AML fines – a 50% jump from 2020. One European bank paid £163 million for weak transaction monitoring. These aren’t simple costs of doing business; they’re survival-level risks.

| Year | Institution | Penalty |

|---|---|---|

| 2022 | Deutsche Bank | $630 million |

| 2021 | Capital One | $390 million |

| 2023 | Binance | $4.3 billion |

Criminal charges now extend beyond corporations to individual executives. Over 70 banking leaders faced personal fines since 2020. Some jurisdictions even impose prison terms for systemic crimes.

Impact on Operations and Trust

When standards slip, customers notice. A 2023 survey revealed 61% of clients switch banks after compliance scandals. Rebuilding trust takes 3-5 years – if institutions survive the reputational hit.

Operational disruptions compound the pain. Regulators often impose enhanced monitoring requirements, forcing costly system overhauls. One Asian bank spent £220 million upgrading data tracking systems post-sanctions breach.

Here’s the kicker: 83% of AML-related business losses stem from indirect impacts like investor flight – not direct fines. Robust frameworks aren’t just about avoiding trouble; they’re about securing your future in an industry where trust is the ultimate currency.

Future Trends in Anti-Money Laundering

The battle against dirty money is entering its smartest phase yet. New tools and cross-border partnerships are rewriting the rules of detection, making compliance faster and more precise than ever before.

Emerging Technologies and Digital Transformation

Blockchain analytics now track cryptocurrency flows across 50+ exchanges simultaneously. AI systems predict criminal patterns by analysing years of transaction reports in minutes. One bank slashed false alerts by 65% using machine learning that adapts to new money-laundering tactics.

Biometric verification is going mainstream. Facial recognition systems cross-check 132 identification points against global watchlists. These efforts help institutions meet stricter KYC requirements while speeding up customer onboarding.

Evolving Regulatory Measures and Global Efforts

International bodies like FATF are harmonising rules for crypto assets and NFTs. Over 30 countries now share real-time alerts about suspicious transactions through secure portals. This cooperation helps freeze funds before they vanish into offshore accounts.

Tighter CDD requirements target shell companies and politically exposed persons. Regulators now demand quarterly risk assessments instead of annual reviews. As criminals exploit metaverse platforms, we’re seeing new reporting standards for virtual asset transfers.

The future belongs to institutions blending smart tech with human expertise. Those investing in these efforts today will lead tomorrow’s fight against financial crime.

Conclusion

Building trustworthy financial systems requires more than policies – it demands action. Robust AML measures, powered by modern tools and thorough customer due diligence, remain vital shields against illicit activities. Our journey through these frameworks shows how they protect both institutions and economies.

Adopting advanced screening technologies and biometric verification systems strengthens defences while streamlining compliance. Regular updates to customer due diligence processes ensure evolving risks stay visible. When institutions prioritise these steps, they build resilience against fines, fraud, and reputational damage.

Effective strategies don’t just meet regulations – they foster safer markets. By investing in tools that automate monitoring and enhance transparency, banks safeguard their operations and public trust. Rigorous customer due diligence acts as both a filter and deterrent, blocking criminal access at entry points.

Let’s keep pushing for smarter frameworks. Continuous improvement in detection methods and cross-industry collaboration will shape tomorrow’s financial security. Together, we can turn compliance into a competitive advantage – one transaction at a time.